Expect More From Your Roof

Your Local GAF Certified Roofer Since 1997

Welcome to Revere Roofing Company. We are a team of industry professionals dedicated to raising the bar when it comes to roofing solutions. We consider it our responsibility to provide the highest quality roofing products, installation services and warranties so you can expect more from your roof.

Over our 25 years, Revere Roofing Company always commits to our core values of integrity, dependability, knowledge and excellence in our field to deliver personalized solutions and service to homeowners and business owners. We are proud to be GAF Master Elite® certified. We received the GAF President’s Club Award multiple times for excellence. You can depend on us whether you have a shingle, flat or metal roofing system in the northeast Ohio area.

Roofing & Gutter Solutions

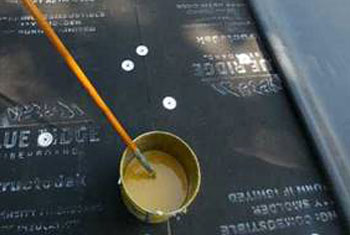

Revere Roofing Company works with different types of roofing, so you have no limits on options when you choose us as your roofer. We install slate, wood shake, metal and flat roofing systems in addition to asphalt shingles. Our team also offers designer asphalt shingles if you want a sophisticated appearance for your roof without the extra cost of a heavier material.

We install aluminum, copper, galvanized and box gutters in your choice of style and color to keep water away from your foundation and landscaping. Whether you have a style in mind or want our professional opinion, we can help you weigh the pros and cons of each material and style we offer.

Why Choose Us?

Residential and commercial customers choose us because of our industry certification, award-winning team, high-quality products and dedication to solving their problems. There’s a reason we are A+ rated with the Better Business Bureau and remain highly rated among our customers. It’s because we commit to understanding their needs and to providing cost-effective solutions for their roofing and gutter systems.

Contact Revere Roofing Company Today

Book an on-site consultation with an expert roofer by contacting Revere Roofing Company today. Call (740) 392-9450 or submit your information using our online contact form.